- Pitch Reviews

- Posts

- This Autonomous Farm Tool Company Can Increase Farm Efficiency By 30%

This Autonomous Farm Tool Company Can Increase Farm Efficiency By 30%

Plus, entrepreneur-turned-investor Andrew Gluck on the Pod!

Heyyyo,

The idea of rolling funds have really picked up traction as of late — mostly due to the sheer number of founders with liquidity wanting to make fundraising (and investing) easier than it has been for them.

What is a rolling fund?? Well, put simply, it’s an investment vehicle that operates with a bunch of LPs or individual angels committing (often, but not always) smaller denominations on an ongoing quarterly (or whatever) basis and the fund runner will typically take a similar 2/20 fee and carry to source and invest in startups, rather than raising a larger complete fund before deploying capital with all of the proceeds allocated to only that single fund.

In short, it allows both the fund and its investors to operate much more flexibly. Another added benefit, or perhaps byproduct of rolling funds is that most fund organizers are still running other businesses and typically have more of an operational approach to investing, which I personally think is very smart given the speed of tech.

I would be remiss not to mention the obvious risk of rolling funds being the lack of experience and low barrier of entry for new investors that are shepherding real money — even if in smaller doses.

To take a deeper dive on rolling funds, I spoke to Andrew Gluck who recently launched his own fund following a stellar exit from a marketing startup he helped build over the past decade (and the source of much of his deal flow and approach to vetting).

Listen to my full interview with Andrew Gluck here: (apologies for the first few minutes sounding like shit 😩 I am a moron and after 1,000 podcasts, I forgot to double check my mic)

Follow me on Twitter @kitun.

Scott

Every week I breakdown startup pitches with the added hook that you can invest whether you’re accredited or not (if you don't know what that means, click here).

👇 If you like what you see here and haven’t already subscribed, please do 👇

Company Bio

Future Acres develops innovative farm tools to help modernize the American farm through autonomous robotics.

We’ve done a bunch of robotics-type startups this year, this one is perhaps the most obvious and easy to understand of the bunch. It’s pretty simple; 30-40% of all farm related activity is just carrying crops and resources around the farm — furthermore, the activity is the number one reason for farm workers physical ailments and relatively short career-spans. Future Acres is attempting to solve this problem by essentially turning farms into Amazon fulfillment centers where autonomous robot carts do all the heavy lifting so workers can focus on yield and spare the physical expense of pushing wheel barrows around the field.

Meet the Founder

Watch my full interview with Future Acres Founder Suma Reddy here.

Suma is an entrepreneur, educator and activist. As Co-Founder and COO of Farmshelf, an indoor farming company started in 2017, she led strategy and operations with a focus on product, manufacturing and Plant R&D. Previously, she co-founded an organic waste-to-energy company and was a founding Managing Partner at a renewable energy fund that successfully developed greenfield utility-scale solar, small hydro, anaerobic digestion and battery storage projects. Prior to that, she was a Communications and Program Director at SKS Microfinance in India which was acquired for $2.2B. Suma started her career as a Peace Corps Volunteer in Mali and she’s also a graduate of The Wharton School.

Suma is incredible. She’s the type of founder investors dream of backing — her education, experience and commitment to building a better world is obvious. The fact that she’s gone through the trials and tribulations of startup life is important. Additionally, her experience in the space should help make her more relatable as she speaks with farmers than your typical tech disruptor. Whether or not she has what it takes to lead a startup to exit is yet to be seen but I’m confident in her ability to persist and give the company (and its investors) better than average odds!

Traction

Backed by Wavemaker Partners, a global venture capital firm with $400M AUM

CEO is a 3x founder with 15 years of AgTech and CleanTech experience

Potential to increase farm productivity by 30%

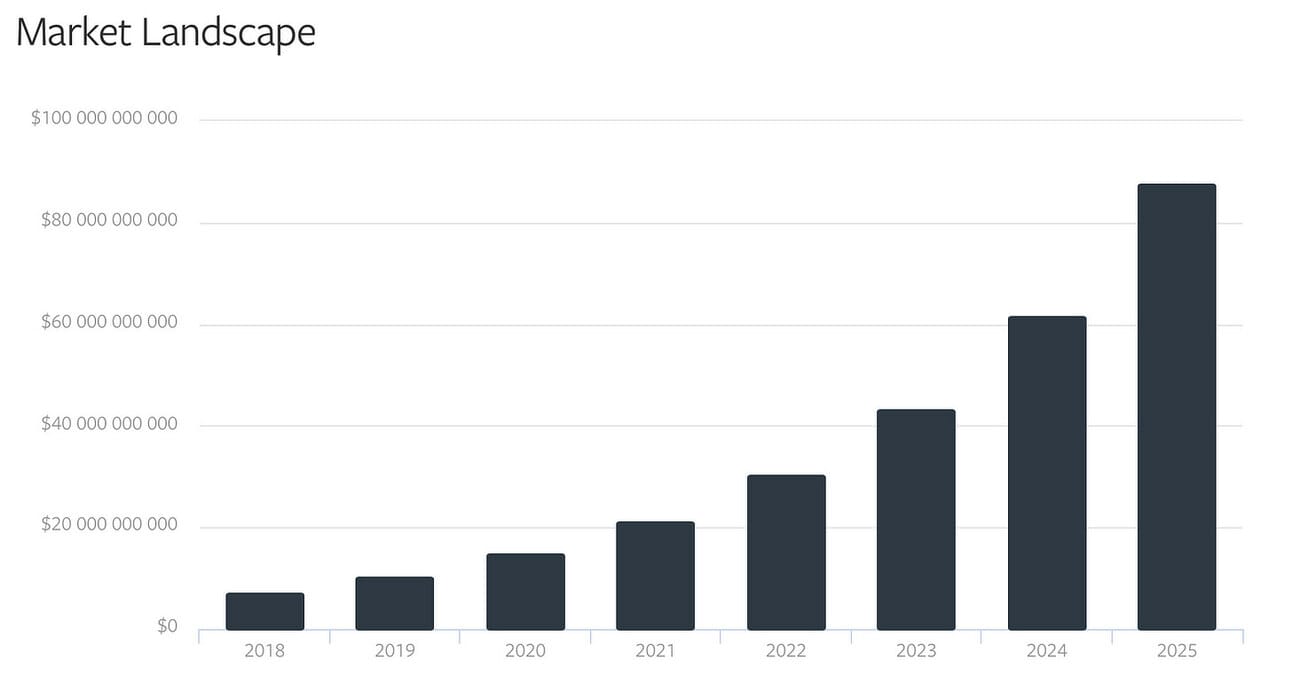

Future Acres is pre-revenue and essentially in the build and pilot stage, but the concept and strategic plan is very sound. Start with the most simple to build and implement tools to prove the value of automation in the fields. The carry as it’s called is novel and at the same time not overly complicated for field workers to utilize — if anything, it should be a relief. Once the initial machine is live, the goal would be to build upon the ecosystem with additional machines and introduce numerous software updates to use data from the machines themselves. Overall, the market is attractive at nearly $50B and it’s also one of those innovations that’s entirely inevitable — which I love.

Terms & Takeaway

Invest in Future Acres here 👉 Term Sheet

Security Type: Preferred Equity

Pre-Money Valuation: $7,000,000

Investment Goal: $1,070,000

Raised (as of publishing): $1,039,429

Minimum Investment: $999.00

Here's what I like: When I invest, I start with the founder — do I believe in them, the vision and their ability to bring it to life. Next, I look for whether or not the problem/solution set is inevitable. And, lastly, what’s the unfair advantage that could set the team apart. In the case of Future Acres, the first two are a resounding yes and as for the third; if you believe education and experience is a key to solving for the future, then they have that too. Bring tech to the farm is challenging, but it’s inevitable.

Here's what I don't love: There is not much to dislike here. The price is more than fair given the TAM and developmental costs. If anything, my only hesitation would be the contract structure of most farms and equipment providers. Suma is going to have to be very strategic as she expands. She must get buy-in from farms but do so without catching the eye of farm equipment monsters like John Deere. Unless, they can strike a partnership deal with with the aforementioned — setting up a potential late stage acquisition.

Who should invest and why: If you like robotics and AgTech, this is a fantastic deal for you. Additionally, the worker shortage and need for farms to upgrade tech in a massive way should provide some strong tailwinds for Future Acres. The deal in question is preferred equity so the minimum investment is higher than a typical Reg CF offering, but if you’re somewhat new to investing, this is actually a pretty strong contender!

As always, startup investing is super high risk, anything can happen.

Invest in Future Acres here 👉 Term Sheet

Questions? DM me on Twitter @kitun