- Pitch Reviews

- Posts

- Invest in an Accelerator Focused on Bridging The Gap Between US Markets and Global Startups

Invest in an Accelerator Focused on Bridging The Gap Between US Markets and Global Startups

Plus, @RobinhoodKid Kayla Killbride on the pod!

Heyyyo,

Twitter is by far my favorite social platform — but not why you might think. Sure, it’s good for news and live-tweeting events. But, I’m here for the parody accounts. #FinTwits to be more specific! It’s fantastic…

I’m 98% on Twitter just for @VCBrags

— Scott Kitun (@kitun)

12:34 PM • Apr 15, 2021

First, they post funny shit. Second, most of that funny shit’s incredibly smart and signals real life action! It’s like comedians before Woke Culture — parody accounts, like jesters, keep the kings laughing (which is important). @RobinhoodKid, who is Kayla Kilbride IRL, is one of my favorites (she’s an even better follow on TikTok) because she’s a relative newcomer to stock trading and she uses her learning curve to point out things that you probably never noticed about trends. To say nothing of the pure entertainment that is watching her and the other #FinTwits “ratio” huge accounts on Twitter … if that last sentence made no sense to you — just give them all a follow.

Listen to my interview with Kayla here 👉 https://apple.co/3xqQ9HE

Here’s a follower list to get started:

For my noobs; every week I breakdown a startup pitch with the added hook that you don’t have to be a rich dude to invest (if you don't know what that means, click here).

If you like what you see here and haven’t already subscribed, please do 👇👇👇

Follow me on Twitter @kitun.

Scott

Company Bio

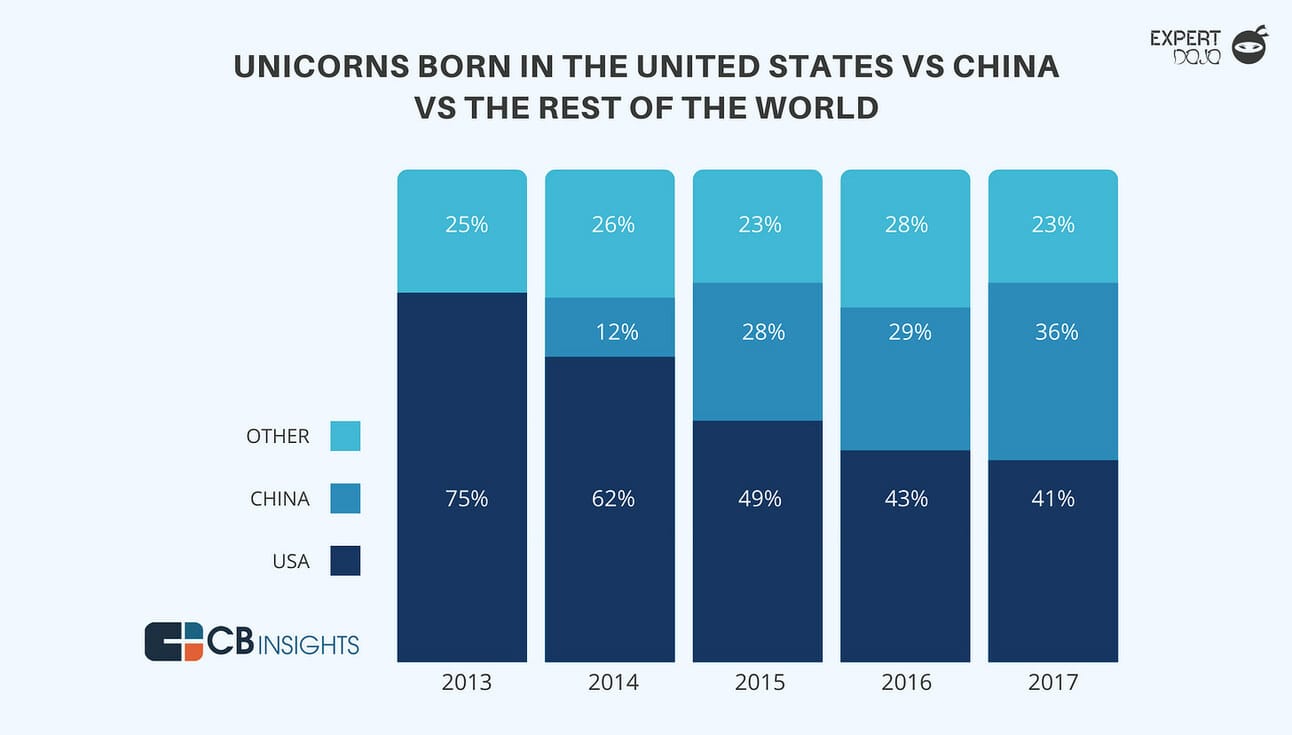

ExpertDojo is a startup accelerator focused on international growth companies.

You’ve heard of y-combinator. It’s pretty much the gold standard of startup accelerators — featuring the who’s who of US startups. ExpertDojo is attempting to recreate some of that magic but with a global twist. Similar to most well known accelerators, their model begins with a small investment of $100k then focuses on helping the founding team scale up quickly.

Meet the Founder

Watch my full interview with ExpertDojo founder, here.

Brian Mac Mahon is a serial entrepreneur and investor and has owned companies in over 35 countries. Brian (and ExpertDojo) is focused heavily on supporting international companies looking for a direct line to US market growth and investment. Prior to starting ExpertDojo, Brian spent a decade working for Regus building out their global growth and expansion.

Brian is a startup lifer. He’s extraordinarily well connected, as you’d expect of someone who participates in as many deals as Brian does, and he has the chops to operate internationally. As far was the success of his program and portfolio — I can say is that startup satisfaction is nearing 95% in reviews and companies ExpertDojo invested in has grown in value by 300% over the past 3 years.

Traction

Expert DOJO has raised a 20 million dollar fund and invested in over 100 companies the past 3 years

The third most active pre-seed investor (US) since COVID-19, right after TechStars and Y Combinator

Portfolio companies we invested in have increased in value 300%

Over 65% of our companies raised follow-ons.

75% of our investments in women and minority founders

One of the most active startup accelerators in the country — probably the largest US firm operating internationally. They operate on a very efficient, high volume VC model that leans heavily on trusting a patented process, investing in founders that buy-in and leveraging their ability to find International gems. Another key differentiator is the number of diverse founders they invest in. They literally do not care where you come from or what you look like.

They just care about your ability to compete!

Terms & Takeaway

Invest in ExpertDojo here 👉 https://bit.ly/3xoLjdW

Security Type: Equity

Valuation Cap: $32,000,000

Investment Goal: $1,070,000

Raised (as of publishing): $766,489

Minimum Investment: $100

Here's what I like: I’m a big fan of diversity. I’ve never understood nepotism (maybe the only child in me), why limit your potential exposure? I especially like the focus on International startups — US investors have been too busy patting themselves on the back while dozens of foreign nations have been aggressively chipping away at the Valley. I’m jealous that I don’t have the eye for global opportunities — I’ll get there, but for now it’s 💯 a blind spot for me.

Here's what I don't love: Just my personal opinion: I think the heyday for accelerators is in the past — just hear me out. There’s but a few programs that do more than dress up your pitch deck or rent their network to you. The list of founders building in public is long and access to case studies, fellow founders and growth capital basically (IMO) makes the rest of the 13-week bullshit, window dressing… my advice is beat the idea into submission, raise a few test bucks and get in the damn boat and start rowing. That said, ExpertDojo brings an extra layer to this process by specializing in international startups. Not only do they greatly open widen the net, but they actually help foreign companies capture US marketshare.

So, perhaps my accelerator fatigue does not apply here!

Who should invest and why: If you’re new to startup investing and really want to get more involved but lack the big bucks needed to be an angel or LP, ExpertDojo is a fantastic way to join a huge community of founders and investors. Furthermore, this investment isn’t in the individual funds themselves, rather the actual entity behind those funds. So an investment here is like betting on the carry ExpertDojo has in the collective portfolio. If Brian and team are successful, you’ll see some dividends as they hit horizons. The obvious risk is that it could take a decade to cash in and there’s no telling how certain funds will perform relative to others. The real question is, would you have invested in YC 10 years ago? If so, this is worth a peak!

As always, startup investing is super high risk, anything can happen. Especially when that startup makes money investing in other startups... 🧨 💸

Invest in ExpertDojo here 👉 https://bit.ly/3xoLjdW

Questions? DM me on Twitter @kitun